Startups seeking venture debt financing can partner with Viva Capital for non-dilutive growth capital that preserves ownership and control without requiring board seats. With over 20 years as an independently owned venture debt provider, Viva Capital offers flexible term loans with competitive interest rates, faster approval than traditional credit lines, and bilingual support for venture-backed companies. Our venture debt solutions help startups extend cash runway, bridge funding rounds, and achieve critical growth milestones while minimizing equity dilution for founders and investors.

What is Venture Capital?

Lack of capital is one of the primary reasons start-up businesses fail.

Since venture debt is becoming increasingly popular, it offers an alternative to traditional venture capital financing, which is mainly used by start-ups needing extra capital launch. VC is money provided by investors to start-ups and early-stage companies with the potential to disrupt markets and grow quickly. This money usually comes from institutional investors, corporations, or wealthy individuals and is exchanged for an ownership stake.

If you’re the owner of a growing start-up company, chances are at some point, you may need working capital.

Unfortunately for most entrepreneurs, this often means that a venture capitalist group will own a significant stake in your company. Depending on your situation, this may not be ideal for someone who built the company from scratch. Venture debt firms, however, typically don’t require as much equity as a venture capital firm.

Venture debt isn’t a direct replacement for venture capital but is becoming a viable option, especially because these firms do not usually take as much equity in a company as a venture capital issuer would.

Venture debt is a form of non-convertible, senior secured loan offered to venture-backed new-age businesses. As a strategic tool to complement equity financing, it offers a wide range of benefits to new-age businesses if used effectively. Venture debt is available as an alternative funding option, providing start-ups with the necessary capital without relinquishing as much control as they would using venture capital.

The Difference Between Venture Debt and Equity Financing

Choosing between venture debt and equity financing depends on a startup’s funding strategy and growth objectives. While both offer access to capital, their structures and implications differ significantly.

Venture debt is designed for venture capital-backed companies seeking to extend their cash runway without giving up additional equity. Unlike equity financing, which involves selling a portion of the company, venture debt is a loan with repayment terms, including principal and interest. It is typically used alongside equity funding to bridge cash flow gaps or finance critical growth milestones with minimal dilution.

Equity financing, by contrast, involves raising capital through the sale of ownership stakes. This option is ideal for startups needing substantial funds to scale rapidly but often results in a loss of control and significant equity dilution.

Startups considering venture debt benefit from maintaining ownership while accessing additional funding. Equity financing may be more suitable for companies requiring extensive resources for expansion. Ultimately, a well-informed decision hinges on understanding venture debt and equity financing and evaluating which aligns best with the startup’s long-term vision. Understanding venture debt vs equity financing round helps startups choose the right funding strategy to balance growth, ownership, and long-term stability.

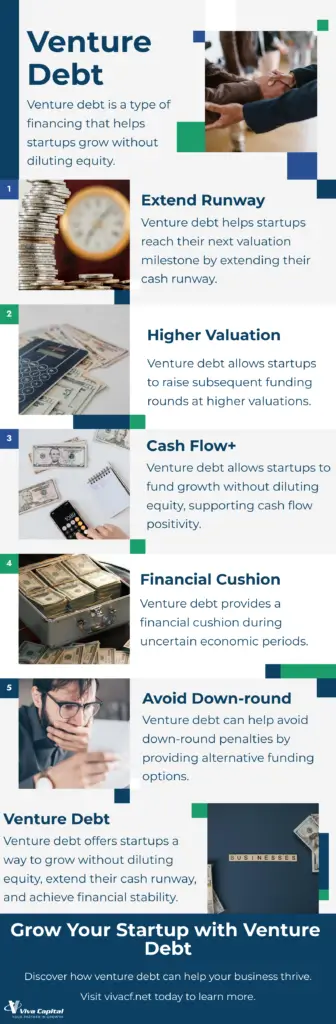

Main Reasons to Consider Venture Debt

- Extend the cash runway of a start-up to the next valuation driver, i.e., venture lending to reduce equity. By decreasing equity, venture debt can be leveraged to ensure the next series is raised at a higher valuation, resulting in less dilution of equity.

- Extend the runway of a company to be cash-flow positive, i.e., venture debt instead of equity. This reduces equity dilution for employees and investors while also driving your company forward during a crucial period of growth.

- Serve as a cushion for what could go wrong, i.e., venture lending to bridge the gap until your company is back on track and avoid a penalizing down round.

When to Take On Venture Debt: Key Considerations

Timing plays a crucial role in leveraging venture debt effectively. Venture debt is particularly effective for startups that have secured equity funding and seek additional capital to extend their runway or reach critical growth milestones. Often paired with equity financing, venture debt provides startups with financial flexibility while minimizing ownership dilution.

For early-stage startups, venture debt can bridge cash flow gaps, helping them scale operations, meet critical objectives, and prepare for future funding rounds. During uncertain times, venture debt serves as a valuable tool, providing a financial buffer against unexpected challenges while preserving control.

However, startups should carefully evaluate their financial stability and capacity to meet repayment terms. Evaluating the cost of capital, including interest rates and potential warrants, ensures the debt aligns with long-term goals. Companies should only take on venture debt when it complements their overall financial strategy, providing the capital needed to achieve sustainable growth. Since venture debt is a type of non-dilutive funding, startups often use it to supplement capital from an equity financing round without giving up more ownership.

The Benefits of Venture Debt Financing Services

With venture debt, startup companies and growth companies that don’t have positive cash flows, significant assets for collateral, or good credit histories can gain access to growth capital. With a reliable venture debt provider, companies can access cash flow or working capital while minimizing their equity dilution and not giving up as much control in their company. Venture debt financing is more flexible, is quicker, and is significantly easier to obtain than traditional lines of credit. Finding a reputable venture debt lender can give your business the financial freedom it needs to grow.

That’s where Viva Capital comes in. As a trusted venture debt provider, we offer venture debt financing, which is a way to raise the same amount of capital without relying solely on a venture capital firm that will require an ownership stake. Through venture debt financing, you don’t have to give board seats to the lender, and both you and the initial investors continue to own the company.

If you’re a company that is in the early stages of building your balance sheet, the traditional route is to offer equity of your company in exchange for a cash infusion. Unlike traditional loans, venture debt typically includes flexible repayment terms, allowing high-growth startups to scale without immediate financial strain.

Venture debt can be used to leverage both equity and debt, meaning the equity is less diluted between the partners involved.

How to Raise Venture Debt Successfully

Successfully securing venture debt requires thorough preparation and a well-defined strategy. Venture debt is more commonly used by startups with existing equity funding to access, providing additional growth capital without substantial ownership dilution. The process begins with identifying venture debt lenders that align with your industry, growth stage, and funding needs.

Critical steps include preparing comprehensive financial projections, crafting a compelling business plan, and showcasing your ability to achieve future milestones. Lenders will assess your cash flow, working capital assets, and overall capacity to meet repayment terms. Transparency in financial metrics is essential, as lenders focus on the ability to meet obligations rather than relying primarily on collateral.

During negotiations, ensure you fully understand interest rates, repayment schedules, and any warrants associated with the agreement. This helps you balance the cost of capital against the advantages of venture non-dilutive financing. Partnering with a reputable lender and aligning venture debt with your growth objectives enables startups to secure the capital required to achieve essential milestones.

At Viva Capital Funding, we want to help you get the best out of your company. To us, that means helping you retain as much control as possible. Hold on to your equity and take your start-up to the next level with us as your venture lender. Choose a venture debt financing firm like Viva Capital and build YOUR company.