What is reverse factoring?

Reverse factoring is a financial product that enables established, credit-strong organizations to maintain or extend their payment terms. At the same time, it gives their suppliers the option of early payment on their open receivables.

Supply chain financing targets the business/buyer, which is why it is commonly referred to as reverse factoring.

By offering reverse factoring to a company, Viva Capital Funding can streamline the supply chain for both the business/buyer and the supplier. This means that both parties can, and will, benefit.

In addition, when it comes to reverse factoring, there are no hidden costs to the business/buyer and little cost to the supplier. This benefit will help maximize the organization’s working capital, which will provide a competitive advantage.

Viva Capital Funding provides a solution to suppliers by offering a stable and consistent cash flow opportunity with an efficient Quick Pay option.

Reverse Factoring and Supply Chain Financing Explained

A conventional factoring service targets the supplier instead of the business/debtor, while reverse factoring instead targets the business/buyer. This is why supply chain finance solutions are commonly referred to as reverse factoring services.

A reverse factoring company can streamline the supply chain for both the business/buyer and the supplier, meaning both parties can benefit. Reverse factoring is available at no additional cost to the business/buyer and little cost to the supplier.

By working with Viva Capital, your business will create a competitive advantage by maximizing your business working capital, as well as providing a solution to your suppliers by offering a stable and consistent cash flow opportunity with Viva’s quick pay option.

What is the Difference between Reverse Factoring (Supply Chain Financing) & Invoice Factoring?

Unlike traditional invoice factoring, the supplier aims to finance their receivables without any involvement or benefit to the business/debtor—supply chain financing is initiated by the ordering entity/buyer. This means companies such as yours may support their suppliers’ financing needs by allowing the supplier to elect an early payment option, known as Viva’s quick pay option.

How Does Reverse Factoring Work?

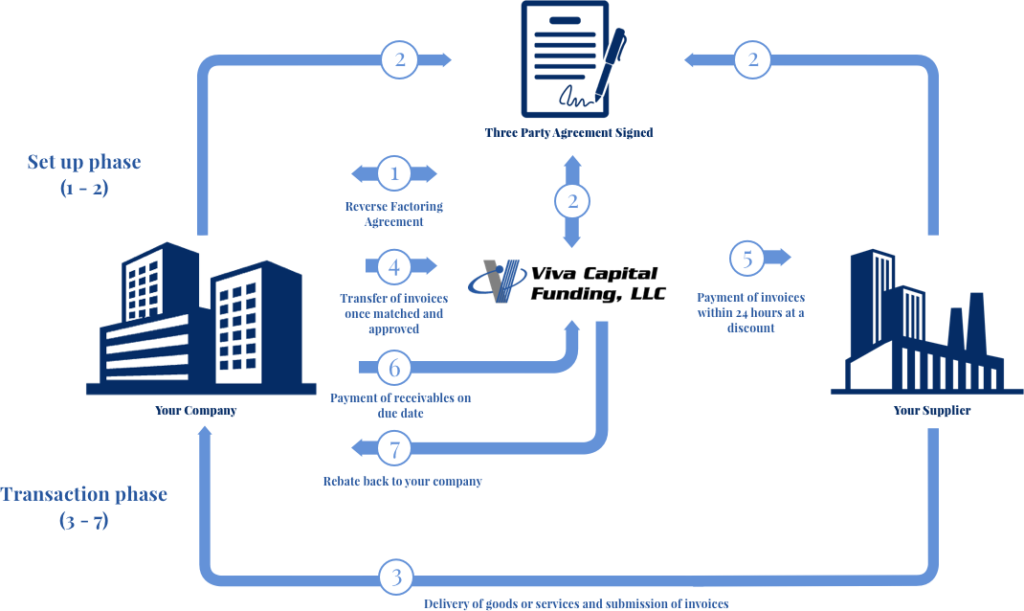

1. The finance company & buyer collaborate and create an agreement.

A funder, also known as a finance company, engages in a third-party agreement with a buyer, allowing all the suppliers associated with that buyer to take advantage of a quick pay or early payment option. The funder would charge the supplier a nominal discount for that early payment option for each invoice selected for quick pay.

2. The finance company & buyer establish when the payment is due.

The funder establishes agreed-upon payment terms with the buyer, which would require the buyer to pay the full amount of the invoice at the determined due date.

3. The reverse factoring process is complete and can repeat as many times as needed.

After all the payments have been collected, the cycle is complete. The supplier is eligible to elect quick pay on more than one accounts receivable invoice at a time, at which time the process would repeat itself.

Reverse Factoring Benefits & Applications

Reverse Factoring Benefits and Advantages for Businesses/Buyers

- Cash flow Improvement – Not only does your business maximize working capital, but your suppliers’ need for an early payment option doesn’t impact your cash flow.

- Reduced early payment requests – Your team will no longer receive as many early payment requests from your suppliers. Suppliers will be paid the same day your company approves the supplier’s invoice in Viva’s quick pay program.

- Supplier financing – Help out your suppliers by making it easier for them to select the specific invoices they want to be paid early.

- Buyer Rebate – The buyer becomes eligible for a monthly rebate from Viva’s quick pay fee collected from the suppliers.

- Nominal discount fee to suppliers– The funder charges a small discount fee to suppliers per invoice in the quick pay program based on the trade credit of the buyer/debtor, which is typically better than the suppliers.

Reverse Factoring Benefits and Advantages for Suppliers

- Nominal discount fee – The funder charges a small discount fee based on the trade credit of the buyer rather than that of the supplier.

- Better cash flow – The funder pays the invoice to suppliers much faster than it would typically be paid, usually within 24 hours from buyers’ approval of the invoice.

- Dispute reduction – Suppliers no longer need to be concerned with non-payment and fraudulent invoices because a third-party financial partner is involved, and all invoices are agreed upon beforehand.

- Reduction in administrative work – You will spend less time dealing with payments and managing invoices and cash flow shortfalls.

- Supplier financing – It is easier for you to select the invoices you want to be paid faster under Viva’s quick pay program.

Reverse Factoring Applications

While many different types of businesses would benefit greatly from reverse factoring programs, it is often most effective for large middle-market businesses. The most highly benefited industries are construction, manufacturing, and oil and gas.

We are experienced in working with a wide range of industries, including: